70 Large AI Investment Rounds in 2024 Across 10 Categories - Part 2

Featuring Employee and Customer Support, Search and Answers, Coding Assistants, Business Task Automation, Robotics and Autonomous Driving

A version of this article appeared as a guest post on the AI Supremacy newsletter earlier this month.

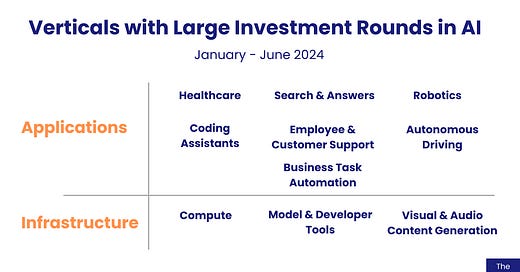

This is Part 2 of the collection of over 70 individual AI funding rounds, from the past six months, from around the world, that are larger than US$50M, and the analysis of the AI areas and the drivers that are considered most promising in the market today.

Part 1 explored the infrastructure layer (Compute, Models and Developer Tools, Visual and Audio Content Generation), as well as the Healthcare application vertical, and Part 2 features the other six segments: Employee and Customer Support, Search and Answers, Coding Assistants, Business Task Automation, Robotics and Autonomous Driving.

As the AI infrastructure layer matures, it provides more types of foundation models, development tools and computing platforms to AI applications developers, who will in turn create a large variety of products across all Enterprise and Consumer verticals. This phase of expansion within the application layer is only beginning and the collection below is the current representation of those use cases that are receiving large individual funding rounds from VCs.

Some of the verticals, such as Robotics and Autonomous Driving, require more significant capital infusions due to larger, hardware-driven CapEx needs, whereas areas such as Coding Assistants, Customer Support, Business Task Automation and Search & Answers benefit from very large markets and use cases that can be transformed by AI-driven content generation and automation.

Employee and Customer Support

A key application for generative AI is the automation of employee and customer support for enterprises. The assistants can handle HR, IT, and other administrative inquiries, facilitate employee on-boarding and training and respond to customer questions across their lifecycle, from product information to checkout and after-purchase support.

Given the wide variety of businesses that can benefit from a streamlined, more cost-effective employee and customer support solution, there is a lot of innovation and development in the space. Start-ups who have raised large investments in 2024 are: Sierra, Cognigy, Parloa and Poly AI.

Sierra provides a conversational platform that enables companies to build AI agents to enhance customer service and the overall customer experience. Based in San Francisco, CA, the company last raised a US$85M round led by Sequoia.

Cognigy offers customer service automation through AI that is instant, personalized, in any language and on any channel. Its platform has pretrained customer service skills, smart self-service and agent assist functionalities. Based in Duesseldorf, Germany, the company last raised a US$100M Series C led by Eurazeo, with participation Insight Partners, DTCP, DN Capital, and others.

Parloa is the developer of an enterprise-grade contact center platform powered by AI. As a voice-first platform, it also supports messaging, automated translation and intelligent routing. Based in Berlin, Germany, the company last raised a US$66M Series B led by Altimeter Capital with participation from EQT Ventures, Newion, Senovo, Mosaic Ventures and La Famiglia Growth.

Poly AI provides effortless CX at scale through their conversational voice platform. It supports 10 languages and a large variety of use cases, from account management and authentication, to billing and payments and booking and reservations. Based in London, UK, the company last raised a US$50M Series C from investors including Hedosophia, NVIDIA, Zendesk, Khosla Ventures, Georgian, Point72 Ventures, among others.

Coding Assistants

AI coding assistants help software developers be more productive and also enable users who are less experienced to build applications and services, thus expanding the number of people who can produce software and internet services. There has been a lot of investment in this space to offer assistants that can cater to a wide range of developers and application requirements, and also to overcome challenges, such as ensuring the accuracy and security of AI-generated code, integrating the tools into diverse development workflows, and maintaining up-to-date training data to reflect the latest programming practices and languages.

The AI assistants that received large investment rounds in 2024 are Augment, Magic, Cognition and Codeium.

Augment is a coding assistant optimized for large codebases, fast inference and support for multiple developers and teams. Based in Palo Alto, CA, the company last raised a US$227M Series B from investors including Sutter Hill Ventures, Index Ventures, Innovation Endeavors, Lightspeed Venture Partners and Meritech Capital.

Magic is working on code generation models through frontier-scale pre-training, domain-specific reinforcement learning and ultra-long context windows. The company last raised a US$117M Series B from investors including NFDG Ventures and CapitalG.

Cognition is an applied AI lab building end-to-end software agents that can be productive developer teammates. Based in San Francisco, CA, the company raised a US$21M Series A in March and an additional US$175M round in April.

Codeium is an AI-powered toolkit for developers that comes as an extension to 40+ IDEs and provides AI code autocomplete, AI search and Q&A in 70+ languages. Based in Mountain View, CA, the company last raised a US$65M Series B led by Kleiner Perkins with participation from Greenoaks and General Catalyst.

Business Task Automation

Business task automation is a space with tremendous potential, as there is a lot of need for improving efficiencies for a wide range of repetitive and time-consuming business processes, ranging from data entry and payment processing to customer service and HR management.

Start-ups in this segment that received large investments in 2024 are H Company, Upstage AI and Klarity.

H Company is working on frontier action models for task automation and decision-making. Based in Paris, France, the company last raised a US$220M round from investors including Motier Ventures.

Upstage AI is developing an AGI for work and provides features such as table and figure extraction from documents, document OCR and information summarization and export. Based in Yongin, South Korea, the company last raised a US$72M Series B from investors including SK Networks, KT, Korea Development Bank, Shinhan Venture Investment, Hana Ventures, Mirae Asset Venture Investment, and Industrial Bank of Korea.

Klarity provides enterprise AI to automate manual business processes related to documents for a variety of use cases, such as contract review, order management, quote / PO matching, invoice processing and loan approval. Based in San Francisco, CA, the company last raised a US$70M Series B led by NFDG, with participation from Y Combinator, Tola Capital, Picus Capital, Invus Capital and Scale Venture Partners.

Search & Answers

Internet and document search and Q&A is a key application for Generative AI for consumers and enterprise both. This year we’ve seen start-ups such as Glean, Perplexity and Genspark build compelling Retrieval Augmented Generation products to help users get answers to their queries in a more natural and user-friendly way. A key challenge in this space is ensuring the accuracy of answers and preventing hallucinations, especially for business- or life-critical queries.

Glean is an AI assistant for enterprise search that connects the knowledge base of a business and provides answers including source documents to employee questions based on their identity and role. Based in Palo Alto, CA, the company last raised a US$203M Series D led by Kleiner Perkins and Lightspeed Venture Partners, with participation from Sequoia, Coatue, ICONIQ Growth, and IVP, among others.

Perplexity AI is a search and answer engine for consumers and businesses which used Retrieval Augmented Generation to provide factual information to user queries. Based in San Francisco, CA, the company this year raised a US$73M Series B led by IVP and an additional US$63M round.

Genspark AI is an AI agent engine that aims to provide a more intuitive and comprehensive search experience by generating custom summaries called "Sparkpages" in response to user queries. Based in Palo Alto, CA, the company last raised a US$60M Seed round led by Lanchi Ventures.

Robotics

Robotics encompasses the full or partial automation of repetitive tasks across a wide variety of real-life applications in verticals such as manufacturing, logistics, healthcare, worker assistants, household robots and beyond. It relies heavily on computer vision and deals with 3D, real-life scenarios, where it needs to perform in safe and human-friendly ways.

Seven robotics companies that raised funding over US$50M this year are Figure, The Bot Company, Bright Machines, Collaborative Robotics, 1X, Physical Intelligence and Bear Robotics.

Figure is building a general purpose humanoid robot to contribute to the workforce, produce more, address labor shortages, and reduce the number of workers in unsafe jobs. Its flagship robot, Figure 01, is 167 cm (5’6”) tall, can carry 20 kg (44lbs), weighs 60 kg (132 lbs), has a runtime of 5 hours and can move at 1.2 m/s (2.7 mph). Figure is based in Sunnyvale, CA, and last raised a 675M Series B from investors including Microsoft, OpenAI Startup Fund, NVIDIA, Jeff Bezos (through Bezos Expeditions), Parkway Venture Capital, Intel Capital, Align Ventures, and ARK Invest.

The Bot Company aims to “build robots that give you time back”. Founded earlier this year in San Francisco, CA, the company raised a US$150M Seed round from individuals like Nat Friedman, Daniel Gross, and Nabeel Hyatt, and VCs like Quiet Capital.

Bright Machines builds full-stack automation tools to improve efficiency in manufacturing processes, driven by AI. Based in San Francisco, CA, the company last raised a US$126M Series C from investors including Blackrock, NVIDIA, Microsoft, Eclipse and Jabil and Shinhan Securities.

Collaborative Robotics builds machines that improve business and manufacturing operations, with customers in segments such as bio-tech, healthcare, logistics and manufacturing. Based in Santa Clara, CA, the company last raised a US$100M Series B round from investors including General Catalyst, Bison Ventures, Industry Ventures and Lux Capital.

1X builds humanoids for everyday life, including NEO, its flagship robot, that is 1.65 m (5’4”) tall and weighs 30 kg (66lbs). Based in Moss, Norway and Sunnyvale, CA, the company last raised a US$100M Series B from investors including EQT Ventures, Samsung NEXT, Skagerak Capital and the Nistad Group.

Physical Intelligence aims to bring general purpose AI into the physical world by developing foundation models and learning algorithms for robots. Based in San Francisco, CA, the company raised a US$70M Seed round from investors including Khosla Ventures, Lux Capital, OpenAI, Sequoia Capital, and Thrive Capital.

Bear Robotics builds AI-powered delivery robots for workers in industries such as restaurants, senior living, hotels, kitchens and entertainment. Based in Redwood City, CA, the company last raised a US$60M Series C from LG Electronics.

Autonomous Driving

Nine companies in the segment that have received large funding rounds this year are Wayve, Motional, Cruise, Terminus Technologies, Applied Intuition, Waabi and Starship Technologies.

Wayve is “Pioneering a New Era for Automated Driving” by producing AI Driver software and advancing Embodied AI. Based in London, UK, the company last raised a US$1.05B Series C round on May from investors including Softbank, NVIDIA and Microsoft.

Cruise focuses on developing the world’s most advanced driverless system and operates a ridehail service in select cities in the United States. Based in San Francisco, CA, the company last raised a US$850M round in June from General Motors.

Motional, a joint venture between Aptiv and Hyundai Motor Group, is working on “making driverless vehicles a safe, reliable and accessible reality”, and it recently received a US$475M funding round from Hyundai.

Terminus Technologies is developing computer vision based systems and software for determining and analyzing vehicle positioning. Based in Beijing, China, the company last raised a US$276M Series D from investors including AL Capital and Yangming Equity Investment.

Applied Intuition provides an ADAS and autonomous vehicle simulation and validation platform for automotive, trucking, construction. Based in Mountain View, CA, the company last raised a US$200M Series E from investors including Lux Capital, a16z and General Catalyst.

Waabi is building autonomous trucking technology in the form of a complete solution designed for factory-level OEM integration, large-scale commercialization, and safe deployment. Based in Toronto, Canada, the company last raised a US$200M Series B, from investors including Khosla Ventures, Uber and NVIDIA.

Starship Technologies develops and operates fleets of food and package delivery robots and provides a delivery-as-a-service solution. Based in San Francisco, CA, the company last raised a 90M round led by Iconical and Plural.

Other

DeepL translates text and documents in 32 languages for consumers and businesses. Based in Cologne, Germany, the company last raised a US$300M round led by Index Ventures, with participation from CONIQ Growth, Teachers’ Venture Growth, IVP, Atomico, and WiL

Daydream is an AI-powered ecommerce startup that provides a fashion search and discovery platform to help customers find and put together desired looks and purchase them. Based in San Francisco, CA, the company last raised a US$50M Seed round co-led by Forerunner Ventures and Index Ventures, with participation from Google Ventures and True Ventures.

So far this year, there has been a lot of investment in a large variety of AI verticals, from compute and development infrastructure, to applications as diverse as coding assistants, healthcare and robotics. 2024 is only half way through and we will continue to see impressive investment rounds in start-ups that can best deploy AI to improve our lives, in the business and personal context.

I’m looking forward to seeing what those will be!

Looking for even more analysis of AI funding rounds? Check out: